Who Can Claim the Children?

Love sometimes does not work. Nothing is more taxing than when one parent claims a child or children without the blessing of the other parent. Who has

You are most likely working more than one job either to increase your income to cover your existing expenses, or to have the security of having another stream of funds building to your overall wealth and net worth. Certainly the last reason you give your time and talents to more than one employer is to give more of your money to the IRS in a tax bill.

Therefore, let’s discuss why working more than one job sometimes result in either a reduced refund or owing more taxes than you originally planned. Then I will later offer a general solution on how you can prevent the likelihood of a surprised tax bill when you have more than one job.

Your Employer is Withholding Taxes Only for the Wage They Pay You

When you work more than one job, each of your employers are only obligated to withhold enough taxes for the wages and other compensation they pay you. Each employer you have is another source of income to you, and each employer is only aware of the respective wages that individual employer pays you.

However, your employers are unaware of the total amount of income you receive from all of your jobs during the tax year. This lack of knowledge is why each employer is likely to not withhold enough taxes for your gross taxable income.

Let’s consider this example:

Taxpayer 1 is single with no children and works 2 jobs. Taxpayer is taking the standard deduction. No additional credits or deductions taken on the return. The tax year is 2022. We are only considering federal taxes for this example:

Job 1: Wages – $35,850 Taxes Withheld – $4,100 Tax Bracket – 12%

Job 2: Wages – $70,850 Taxes Withheld – $11,210 Tax Bracket – 22%

The amount withheld by each job is enough only for the wages paid by each job. A return requires combined amounts.

When you combine the wages and withholdings, the taxpayer received $106,700 in total wages for 2022 and the taxes required for $106,700 received by a single taxpayer is $19,444. The taxpayer is now in a higher tax bracket at 24%. The taxpayer will owe $4,134 in taxes.

You Have a Tax Bill Because You Skipped the Multiple Jobs Worksheet on Your Form W-4

Your Form W-4 tells your employers how much taxes to withhold from your wages for federal taxes. Each state that has income taxes have their own withholding form.

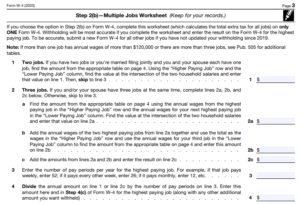

When completing Form W-4, if you have more than one job you must pay attention to step 2(b) of the form. This step will require you to complete a worksheet to tell you how much in additional withholdings you should have taken out of the wages of your highest paying job.

This is a snapshot of the worksheet for Form W-4:

You Have More Sources of Income That Require Additional Withholdings

Wages are only one source of income that require tax withholdings. You may receive retirement or pension distributions, social security benefits, interest income, and even unemployment.

If you have other sources of income, or if you and your spouse have multiple sources of income, in addition to wages, you may need to make estimated tax payments in addition to increasing your tax withholdings. Estimated tax payments may be necessary if you have taxable income such as self-employment income, rental income, and investment income.

The IRS does provide a complimentary tax withholding estimator if you want to try to compute your tax withholdings yourself. But if your financial situation is more complex with multiple sources of income, or you would rather delegate this to a professional, you are invited to schedule a tax planning session to a customized calculation of how to adjust your taxes as well as to answer your concerns about your tax matters.

Love sometimes does not work. Nothing is more taxing than when one parent claims a child or children without the blessing of the other parent. Who has

Sometimes pictures can be helpful to share information. But many times those same photos will either cut off the edges of important documents, or blur the images

If you currently have a payment plan, or an installment agreement, with the IRS to payoff the tax balance you owe, the IRS now allows you to

General Inquires: [email protected]

Office Hours: Tuesday – Friday 9am – 3pm EST | Saturday by appointment only | Sunday and Monday CLOSED

Closed on U.S. Holidays

Mailing Address: 5004 Honeygo Center Dr, 102-265, Perry Hall, MD 21128

© 2025 NEL TAX AND FINANCIAL SOLUTIONS | all rights reserved.

DISCLAIMER | Privacy policy | Terms of Service | cancellation policy | Payment and licensing policy | Refund and return policy